POWER INTEGRATIONS (POWI)·Q4 2025 Earnings Summary

Power Integrations Beats Q4, But Shares Slide 8% on Weak Guide and Layoffs

February 5, 2026 · by Fintool AI Agent

Power Integrations (NASDAQ: POWI) delivered a solid Q4 2025 beat, with revenue of $103.2 million and Non-GAAP EPS of $0.23 both exceeding Street expectations. However, the semiconductor company's stock fell approximately 8% in after-hours trading as investors digested soft Q1 2026 guidance, a 7% workforce reduction, and a leadership transition at the chairman level.

Full-year 2025 revenue grew 6% to $443.5 million, driven by a 15% increase in the industrial segment and 40%+ growth in PowiGaN products.

Did Power Integrations Beat Earnings?

Yes — POWI beat on both revenue and EPS, but the magnitude differed:

Revenue and EPS consensus from S&P Global. Actuals from company 8-K.

The EPS beat was driven by favorable tax provisions, with a GAAP tax benefit of $2.1 million in the quarter. Revenue was down 13% sequentially from Q3 2025's $118.9 million, and down 2% year-over-year from Q4 2024's $105.3 million.

What Did Management Guide?

Q1 2026 guidance came in largely in-line with consensus, but the weak sequential trajectory and restructuring charges weighed on sentiment:

Key guidance considerations:

- Q1 guidance includes $3.5-4.0M restructuring charge related to 7% workforce reduction

- Dividend increased 2.4% to $0.215 per share (payable March 31, 2026)

- Effective tax rate steps up to 7-8% for 2026 (vs. 2% in 2025) as solar credits non-recurring and foreign earnings tax increases

- Industrial expected to be fastest-growing market again in 2026, starting with a strong Q1

How Did the Stock React?

After-hours reaction: Down ~8.5% — trading at $43.21 vs. $47.20 close.

Despite the earnings beat, the stock sold off on:

- Weak sequential momentum — Q4 revenue down 13% QoQ

- 7% layoffs — signaling demand uncertainty

- Chairman transition — Balu Balakrishnan stepped down

- Q1 guide lacks upside — midpoint in-line with Street

Market data as of after-hours February 5, 2026.

What Changed From Last Quarter?

Negative developments:

- Revenue down 13% sequentially ($118.9M → $103.2M)

- Announced 7% workforce reduction with $3.5-4.0M restructuring charge

- Chairman Balu Balakrishnan stepped down; Balakrishnan S. Iyer appointed as new independent Chairman

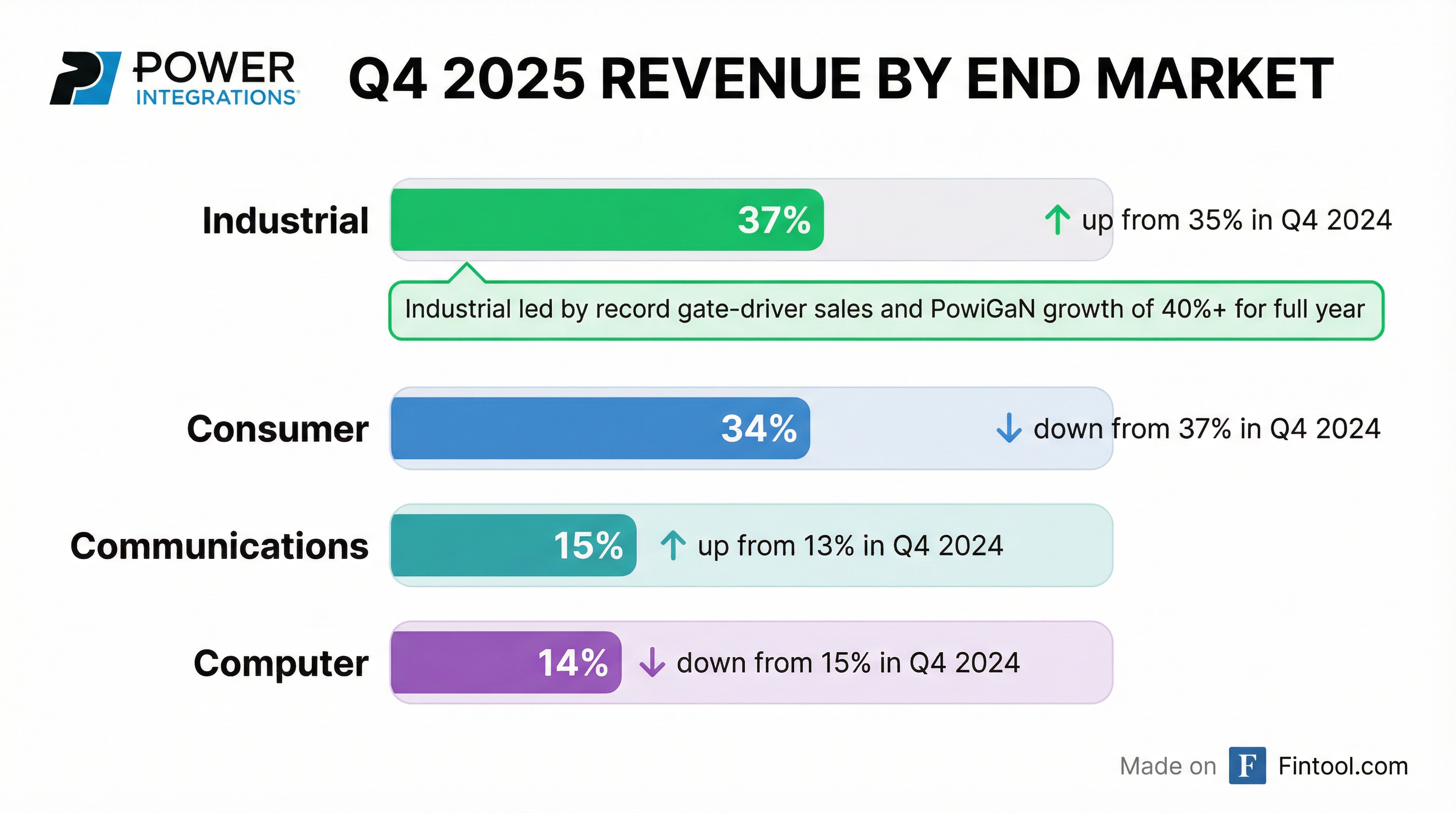

- Consumer segment continues to decline (34% of revenue vs 37% in Q4 2024)

Positive developments:

- Full-year revenue grew 6% YoY, non-GAAP EPS grew 8%, operating cash flow $112M (up $30M YoY)

- Industrial segment grew 15% for full year, led by record high-power gate-driver sales

- PowiGaN products grew 40%+ for the full year

- Bookings "improved significantly in Q4" after slowing in prior quarter

- Channel inventory reduced to 9.4 weeks (down ~0.5 weeks from Q3)

- Design win value grew 10% in 2025, with strength in GaN and high-power products

- New server auxiliary design began production for US cloud services provider

New CFO's Operational Priorities

Nancy Erba, who joined from Infinera (sold to Nokia) one month ago, outlined her initial focus areas:

- Rigorous operating cadences — Establishing disciplined forecasting and execution processes

- Strengthening processes — Improving operational consistency

- Leveraging automation — Driving efficiency and scalability

- Inventory management — Targeting reduction in both channel weeks (9.4 weeks currently) and balance sheet days (313 days)

- OpEx discipline — Targeting OpEx growth at half the rate of revenue growth

Revenue Mix by End Market

Industrial strength: CEO Jen Lloyd noted the industrial category grew 15% for the full year, "driven by record sales in our high-power gate-driver business, plus strength in metering, power tools, automotive and broad-based industrial applications."

AI/Data Center opportunity: Management highlighted that "AI data centers, electrification, grid modernization and other macro trends drive demand for innovative high-voltage technologies."

Key Management Quotes

CEO Jen Lloyd on 2025 performance:

"I'm also pleased to report that we returned to growth in 2025. Full-year revenue was up 6%, non-GAAP EPS grew by 8%, and we generated $112 million of cash flow from operations, up $30 million from the prior year."

CEO on strategic positioning:

"Advanced high-voltage technologies are essential to the emerging power ecosystem. Our solutions span from the generation of renewable energy to long-distance DC transmission, to battery storage, to smart meters at the edge of the grid, to the efficient use of power in homes, factories, data centers, and vehicles."

CEO on customer focus transformation:

"We need to reorient our organization to ensure that our strong technology foundation translates to success in the market. That means a more customer-focused approach to product development and faster time to market."

CFO Nancy Erba on investment discipline:

"We're going to be cautious in our investments until we see those bookings really taking form and the step-ups that we expect to see, making sure that they are happening before we dive in deeper to certain investment areas."

Financial Trend Summary

Non-GAAP EPS values retrieved from S&P Global.

Capital Allocation

Shareholder returns: POWI returned $145.3M to shareholders in 2025 through dividends ($47.2M) and share repurchases ($98.1M). The company increased its quarterly dividend by 2.4% to $0.215 per share.

Leadership Transition

Effective February 5, 2026:

- Balu Balakrishnan stepped down as Chairman of the Board but remains as a director

- Balakrishnan S. Iyer appointed as new Chairman (independent director)

- Lead Independent Director role eliminated as new Chairman is independent

The company also approved a revised form of indemnification agreement for directors and officers.

Risks and Concerns

Near-term headwinds:

- Soft Q4 revenue (down 13% QoQ, down 2% YoY) signals continued demand uncertainty

- 7% workforce reduction suggests management sees prolonged weakness

- Consumer segment continues to shrink as a percentage of revenue

Tariff exposure: The company highlighted in its forward-looking statements that "changes in trade policies, in particular the escalation and imposition of new and higher tariffs, which could reduce demand for end products that incorporate our integrated circuits and/or place pressure on our prices."

Inventory concerns: The balance sheet shows inventory of $166.9M, essentially flat from $165.6M at year-end 2024, suggesting limited destocking progress.

Q&A Highlights

On channel inventory (Ross Seymore, Deutsche Bank): CFO Nancy Erba confirmed channel inventory fell to 9.4 weeks (down ~0.5 weeks QoQ) and outlined plans to bring inventory "back to a more healthy level" during 2026, though noted it depends on Q1/first half bookings patterns.

On automotive timeline (Tore Svanberg, Stifel): CEO Jen Lloyd indicated the $10-20M automotive revenue opportunity is more of a 2027 target than 2026 due to EV market delays, but emphasized continued design wins: "Whether it's 12 months or 18 months, I think that's the window we're thinking about."

On data center strategy (Christopher Rolland, Susquehanna): Management clarified that aux power is an "entry socket" for data center customers, with main power supplies — representing a "much more significant SAM" — currently in development. The NVIDIA 800V DC architecture engagement uses POWI's 1700V GaN solutions.

On 2026 growth expectations (David Williams, Benchmark): CFO Erba stated the company is "planning for similar growth levels year-over-year" (6% in 2025), but will be "cautious in our investments until we see those bookings really taking form."

On consumer segment exit risk (Tore Svanberg, Stifel): CEO Lloyd pushed back on consumer exit speculation: "I don't think there's anywhere right now that we've identified in terms of exiting. It will still be a growth segment for us."

On OpEx trajectory: CFO Erba indicated OpEx savings of $3-5M for the full year from the 7% headcount reduction, with partial Q1 impact. The company is also reassessing all programs under new marketing head Chris Jacobs.

New Executive Team Additions

Management highlighted several key hires to support strategic transformation:

CEO Lloyd emphasized "much more openness in terms of our roadmaps and our product development discussions" with customers, particularly in data center where the company is "pivoting focus areas" to address market needs.

Forward Catalysts

Watch for in coming quarters:

- Industrial momentum sustainability — Can gate-driver and PowiGaN growth continue?

- Restructuring benefits — $3.5-4.0M charge should improve cost structure in 2H 2026

- AI data center adoption — Main power supply development for NVIDIA 800V architecture in progress

- Automotive ramp — $10-20M opportunity over next 12-18 months from design wins

- Consumer recovery — Any signs of stabilization in the 34% of revenue from consumer

- Tariff policy clarity — U.S. trade policy could materially impact demand

- Channel inventory normalization — 9.4 weeks targeted to decline further in 2026